Formed by MIT (Massachusetts Institute of Technology) engineers, 3D printer manufacturer New Valance Robotics (NVBOTS) is taking financial steps to gain more power. Grabbing attention with NVPro who can build its own parts, the firm stated to receive support from Woodman Asset Management.

Established in 2015 by MIT engineers, Boston based NVBOTS starts financial and institutional innovations to raise its presence in 3D sector. The company received A funding from Woodman Asset Management. Providing plastic and metal printing service to sectors, NVBOTS is expected to speed up R&D projects.

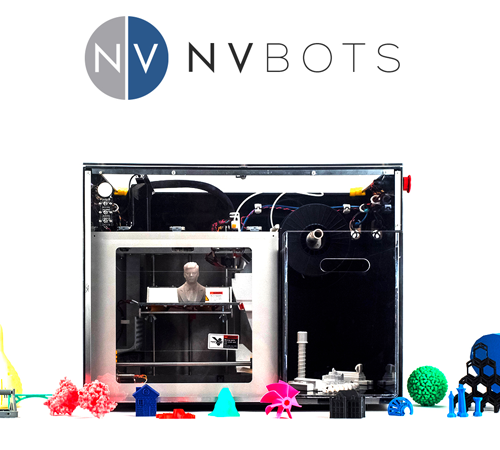

NVBOTS has received Series A financing led by Swiss firm Woodman Asset Management. The funds will boost the company’s development of their multi-metal printers, as well as expand sales of the NVPro plastic printer, which has already been a popular and successful product; high-profile customers include Staples and Hypertherm, among others. The release of NVBOTS’ high-speed, wire-feed metal printers is expected to have a big impact on the metal 3D printing industry, offering not only higher speeds but lower costs and power consumption – as well as expanding NVBOTS’ client base to the automotive, aerospace, defense, industrial and medical industries.

“We are pleased to lead the NVBOTS financing,” said Dr. Alexander J. Bischoff, Head of Venture Capital at Woodman. “The market for cost-effective, fast, and automated 3D printers is well over $10 billion. NVBOTS; with its established NVPro plastics printing platform, high-speed metal printing technology, and exceptional team; is poised to lead this rapidly growing category.”

In addition to the increased capital, NVBOTS has also acquired a new CEO. Duncan McCallum brings two decades of experience in launching and funding new business ventures. He co-founded and led Cilk Arts, since acquired by Intel, and VeloBit, now part of Western Digital. Before that, he was a venture capitalist at Bessemer Venture Partners; for whom he led early stage investments in 16 companies that have since gone on to produce an aggregate market capitalization of over $1.5 billion.